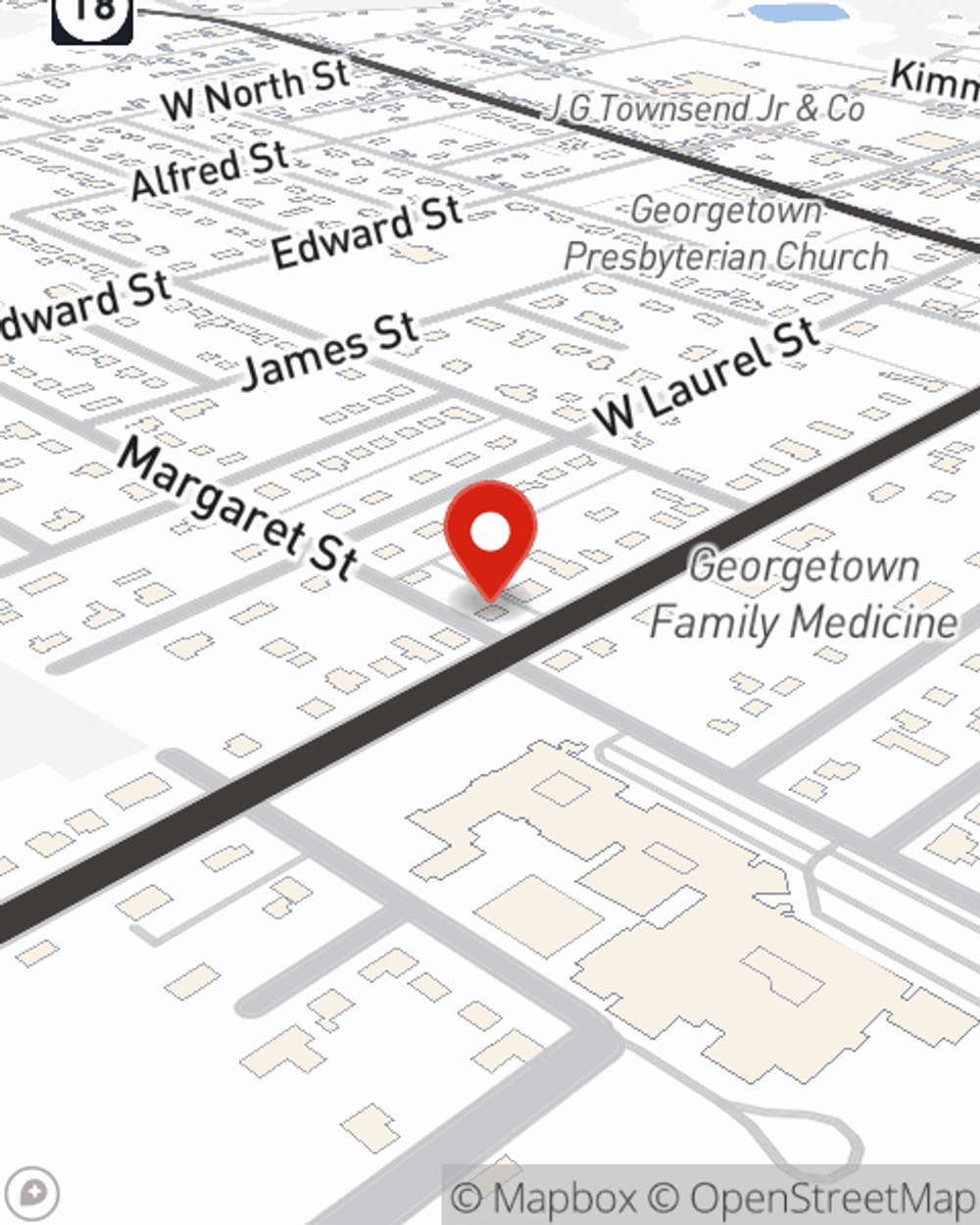

Homeowners Insurance in and around Georgetown

If walls could talk, Georgetown, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Home is where friends always belong love resides, and you enjoy coverage from State Farm. It just makes sense.

If walls could talk, Georgetown, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

For insurance that can help cover both your home and your mementos, State Farm has options. Agent Hunter Emory's team is happy to help you set up a plan today!

Your home is a big deal, but unfortunately, the unanticipated circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Hunter Emory can help you put together the right home policy!

Have More Questions About Homeowners Insurance?

Call Hunter at (302) 855-2100 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Hunter Emory

State Farm® Insurance AgentSimple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.